Why Cambodia is considered as one of the best places in the world to invest in 2023?

Following the end of the war in 1991 and the disintegration of the Khmer Rouge movement in 1998, Cambodia’s reconstruction strategy banked extensively on the opening of its economy to free market principles, the adoption of business-friendly policies, and the attraction of foreign direct investment.

In combination with a young and affordable workforce, the reduction of the role of the State in the economy, the adoption of the Law on Investment in 1993 (later amended in 2003 and again in 2022), membership in the World Trade Organization in 2004, and privileged market access granted by the United States and the European Union, contributed to boosting foreign direct investment which came to represent 13.5 percent of GDP in 2019

There is every reason for us to believe Cambodia is Asia's best country for investors. In August 2022, AI Consulting has been incorporated to focus on Cambodia, because of 11 main factors that recently raised the trust among foreign investors and businesses interested in Cambodia’s market potential and opportunities.

I) First off, Cambodia has proven to be extremely resilient over the long term. They haven't suffered a recession for over 25 years, in fact, despite Asian Financial Crisis of the 1990s and global financial crisis of 2008.

The reason for this track record is because, as a frontier market, Cambodia is less correlated with the global economy.

1.1 The economic growth rate of Cambodia during the past 5 years before the pandemic is in line with the economic growth trajectories of Singapore, Hong Kong, Taiwan, and Korea between 1960 and 1990, which was 6% per year. Economic growth at this rate has made these countries the tigers of Asia, and so does Cambodia.

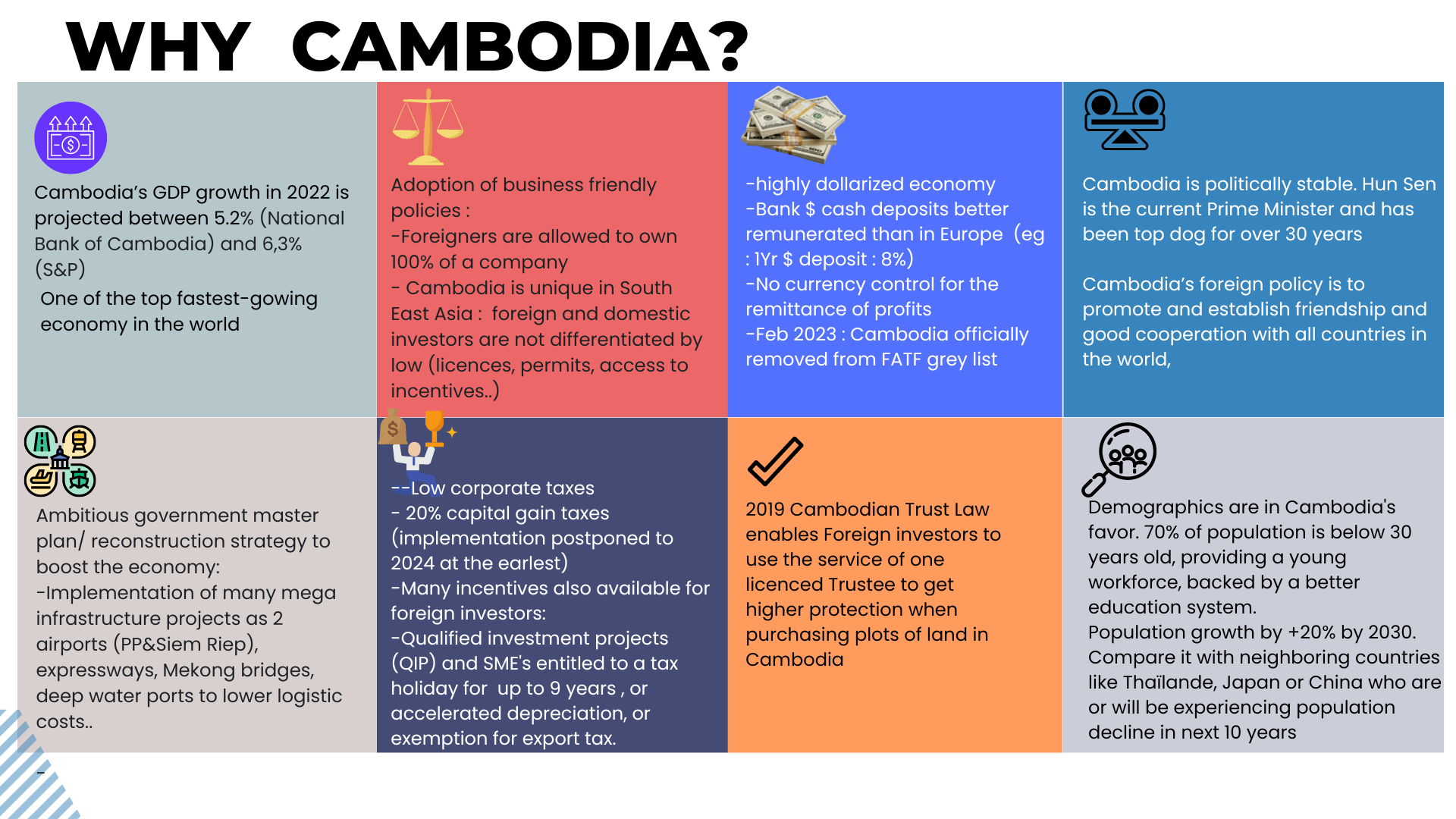

1.2 Cambodia’s GDP growth in 2022 is projected between 5.2% according to last figures of National bank of Cambodia, to 6.3%, according to the S&P Global Rating, which is one of the highest projections in the region. This makes Cambodia one of the top fastest-growing economy in the world.

Projections made by the World Bank, the International Monetary Fund and the Asian Development Bank are all in [5.2% - 6.3] range for 2022, which is impressive considering geopolitical crises and the partial disruption of global supply chains that have posed difficulties for the Kingdom, notably in terms of inflationary pressures and FDI inflows. Growth in the agricultural sector, increased exports, and a rebound in the construction and tourism industries are main drivers behind good GDP figures.

1.3 “…Cambodia’s long-term growth story remains intact, given its competitive cost structure and young population, making it one of the fastest-growing economies in the world,” said S&P primary credit analyst Ivan Tan.

Many Chinese and American analysts have forecasted that Cambodia could have a chance to become the “tiger of Asia of the 21st century” in the near future, after the end COVID-19 pandemic and global uncertainty.

2) The Cambodian government, very stable for last 30 years with Prime Minister Hun Sen, has been implementing master plans and agendas to boost the economy; for instance, the mega plan to transport project to transform Sihanoukville into a multi-purpose special economic zone, the development of many mega infrastructure projects as airports, PP-SHV expressway, among others. This will lower the cost of logistics in Cambodia, which is a highly-competitive factor.

3) Cambodia is unique in the region in that foreign and domestic investors are not differentiated by law. The requirements for licenses, permits, and other procedures are the same for both domestic and foreign companies. In Cambodia, the Ministry of Commerce is broadly responsible for regulating the registration of companies in Cambodia, while the Council for the Development of Cambodia (CDC) has the authority to grant investment incentives to qualified investment projects.

New investment laws and incentive policies also play an important role in attracting investors. For example, the policy that allows a foreigner to 100% owns a private company. This is deferred to Thailand which requires Thais to have at least 51% of the total share in the company. Policies such as minimum capital to start a company as slow as US$1,000 and low corporate taxes are also attractive factors.

4) Incentives for Investment in Cambodia

Investment incentives are available to both domestic and foreign investors, whether in the form of qualified small medium-sized enterprises (SMEs) or qualified investment projects (QIPs) elected by CDC.

By example, companies granted a QIP are entitled to a tax holiday for up to nine years, or to accelerated depreciation, or to exemption from export tax.

5) Foreign investors wanting to purchase land in Cambodia can now access more secure, simple, and affordable trust arrangements using the service of one licensed Trust provider, through the 2019 Cambodian Trust Law.

Actually under the 1993 Cambodian constitution, foreigners are not able to legally hold land titles in their name and have previously navigated this requirement through a Nominee structure or a Land Holding Company. This could solve the title-holding problem for investors, but ongoing concerns including fraudulence or high hidden fees could happen and hurt property buyers’ confidence for investing in Cambodia.

The most significant advantage of the 2019 Cambodian Trust Law is that the property would receive higher protection if held by a licensed trustee.

A licensed trustee should follow regulations and the process of registering every property and getting the certificate of trust registration. However, of course, there will be some extra expenses for registration, such as application fees, valuation reports, and documents to fulfill the requirement.

To address these higher registration fee issues the regulator has now lowered the application fee to encourage investors to use trust structures with many investors firmly believing this is an investment that is worth spending to provide safety for their property.

6) Being a highly dollarized economy makes Cambodia enjoy stabilized exchange rate, which preferable incentive to the export-import businesses.

Breaking news : Last Feb 24th, 2023, the Paris-headquartered Financial Action Task Force (FATF) officially removed Cambodia from its grey list of high-risk countries for money laundering. Cambodia has earned the trust of global regulatory agencies and can benefit from improved foreign investment, as well as access to international markets and trade agreements.

7) Cambodia has become a member of free trade agreements and Regional Comprehensive Economic Partnership, especially with China.

8) Demographics are in Cambodia's favor. 70% of population is below 30 years old, providing a young workforce. Their population will also increase by over 20% by 2030 which will help drive growth and regional influence. These human resources are improving in quality thanks to a better education system.

Looking at demographics is crucial to forecast long-term growth and Cambodia's are great. Compare this with Japan, China, and Thailand which are either experiencing population decline or will in the next 10 to 20 years

These human resources are improving in quality thanks to a better education system.

9) Compared to all countries in Southeast Asia, Cambodia is considered an investment-friendly country. Many laws and regulations are in the stage preparing, which is highly favorable and flexible compared to other developed countries.

10)As for the remittance of profits or other fund transfers, there are no currency controls in Cambodia, and companies and individuals are allowed to freely remit funds from Cambodia so long as the funds are sent through a licensed bank.

11) Cambodia is more accessible to foreigners with better and more diverse tourism, entertainment, and hospitality services. This factor not only attracts tourists but also makes investors want to live and work in Cambodia.

Recently many international investors like institutional funds or HNW private clients, who are fully conscious of the huge potential of Cambodia, have initiated investments in the Kingdom.

Large international groups like Decathlon, Peugeot, Pernod Ricard, 7 Eleven, Pizza Hut, Bose, …, have decided to develop their activities into Cambodia.

BIG 4 players like KPMG or Deloitte also recently promote Cambodia to their clients.

e stated the reason why he chooses Cambodia as an investment destination: “Because Cambodia has very stable government-for over 40 years in Cambodia history, it is also the first time for Cambodian to live in peace and prosperity. It is very important for investors like myself to invest in Cambodia because of the stability of the government, Cambodia is very peaceful without any violence, without any major crime, unlike other countries, Cambodian people are very humble, smart, and have a strong working ethic. The labor force is very large, and everyone is eager to learn to improve themselves. Furthermore, the government provides a very good incentive to all Foreign Direct Investment (FDI) and full protection to all investors like myself.”

In the first six months of 2022, the Council for the Development of Cambodia (CDC) also approved 63 private investment projects outside of the Kingdom’s special economic zones (SEZ), which is an improvement of 18 projects compared to 2021 over the same period.

Keep in mind that China is still battling COVID-19 in its own way which is preventing the levels of investment and travel experienced before the pandemic. Regardless, Cambodia still attracted fixed-asset investment from China worth $1.29 billion in the first half of 2022 and China remains the top foreign investor in Cambodia, accounting for 43 per cent of the total foreign investment (worth $2.99 billion during the January-June period.